Cryptocurrency regulation: threat or opportunity?

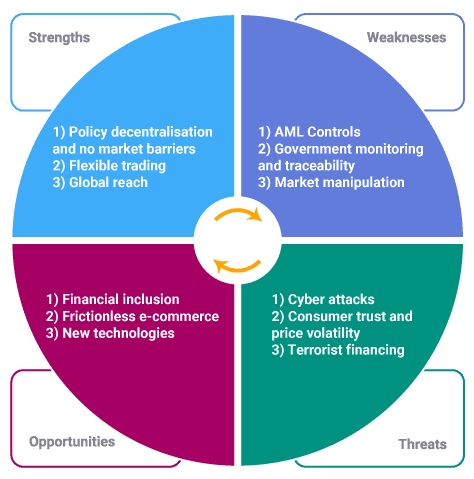

Cryptocurrencies are increasingly a fact of life in today’s financial world. Despite early misgivings about the shady character of cryptocurrencies – the very name stems from the Greek word kruptos, meaning hidden – their many advantages – security, flexibility, traceability, speed, confidentiality – have seen them rise irresistibly.

But cryptocurrencies bring risks too. They exist in a space that is not easily accessible to national regulators, making it hard to police their effect on market integrity. They also bring risks in terms of lack of governance, lack of consumer protections, and lack of safeguards against market manipulation. The confidentiality they enable also makes cryptocurrencies attractive to those involved in money laundering and terrorist financing.

The shape of things to come

Will any of this prevent cryptocurrencies taking their place alongside other more conventional global currencies? Should those in charge of safeguarding the integrity our financial systems be concerned? In theory, there’s no reason why all transactions should not one day take place via cryptocurrencies – assuming we all have access to appropriate technology. Cryptocurrency advocates would welcome such a future. National regulators around the world might have one or two reservations.

Anticipating that technology-driven advances don’t always hang around for governments to make up their minds about them, regulators around the world have attempted to develop common global standards aimed at mitigating the risks associated with cryptocurrencies. Perhaps predictably, their efforts have been significantly hampered by divergent local approaches, and little has been achieved so far.

The trouble with crypto assets

Meanwhile, some of the potential problems with cryptocurrencies have been making themselves apparent. Retail investors are having their digital pockets picked at scale. Cryptocurrency exchange platforms have seen hundreds of millions of dollars spirited away by hackers and cyber criminals.

The FCA estimates that $731 million worth of crypto assets went missing from exchanges in 2018, a figure that excludes the countless unreported incidents of theft from individual e-wallets.

Europe believes cryptocurrencies are involved in money laundering worth £3-4 billion each year in Europe alone. National governments around the world are unanimous in voicing their determination to protect their consumers and tackle crypto crime. But thus far their attempts at exerting their supervisory powers in the crypto space have met with mixed results.

New UK regulations

The UK is home to the largest cryptocurrency market in Europe and is forecast to play an even more significant role over the coming five years. On 10 January this year, as part of the implementation of the EU’s Fifth Money Laundering Directive (5MLD) into UK law, the FCA took responsibility for supervising anti-money laundering compliance within the cryptoasset sector. The Money Laundering and Terrorist Financing (Amendment) Regulations 2019 (MLR 2019) bring 5MLD into force in the UK.

As part of its newly acquired crypto supervisory role, the FCA has put in place clear and precise guidelines that crypto firms must follow in terms of AML controls and internal governance.

New AML rules

All firms engaging in crypto-related activities must now embed adequate AML controls for those who use their systems – including proper controls and procedures for verifying the payer, payee, transaction volume, and address. AML controls are effectively an insurance policy that safeguards the entire crypto community from potential fraudsters, money launderers, terrorist funders, corrupt officials, and other actors involved in dubious transactions they would prefer to conduct without an audit trail attached.

Firms the FCA has said must comply with the latest AML registration include:

-

- Peer to peer providers

- Custodian wallet providers

- Cryptocurrency exchange providers

- Initial coin offering (ICO) providers

- Initial exchange offering (IEO) providers

- Cryptoasset exchange providers – including cryptoasset ATMs

An opportunity, not a threat

Less enlightened crypto firms might be tempted to view these regulations as an unwanted cost or a burden. But pioneering crypto firms will recognise an opportunity to align their products and services with the highest standards – and so position themselves as future market leaders.

Rather than representing an operational bottleneck or a driver for higher churn rates, AML controls create a degree of confidence and assurance that will benefit – not just clients, government regulators, and third parties – but the crypto community as a whole.

Pioneering crypto firms who adopt high internal governance standards are now selling their sophisticated compliance-cutting edge controls to their corporate and retail clients. As they gear up to comply with 5MLD by the FCA’s deadline 30 June 2020, such firms are building competitive advantage.

Time to act

Putting in place the necessary processes and support frameworks to implement strong AML/CFT principles must be a priority for any crypto business now. Nor can this be treated as a one-off investment. Regulated persons will need to monitor the landscape constantly in future for emerging criminal tactics – and be prepared to adapt their existing frameworks quickly and effectively to put in place procedures that effectively combat these risks.

Anyone involved in the crytoassets sector now needs to recognise that AML/CFT regulation is not a passing trend. They need to be prepared to embed these principles at the core of their activities going forward. Crypto businesses have been able to submit registration applications via the FCA Gateway since 10 January 2020. If you haven’t already done so, the time to act is now. The FCA’s hard deadline of 10 January 2021 will be upon us sooner than you think.

The good news is we can help. Email our expert Cryptoassets team at info@thistleinitiatives.co.uk or call us on 0207 436 0630 and we can guide you through the process.