A2A payments now worth more than $500bn

Summary

Worldpay’s Global Payments Report revealed that account-to-account (A2A) payments are now worth $525bn globally, and projected to grow at 13% year-on-year between now and 2026.

While A2A payments have been around for some time, in the form of inter-bank payments, the report says they are growing fast thanks to the rising number of real-time payments (RTP) rails implemented in 64 markets around the world – four more than existed last year.

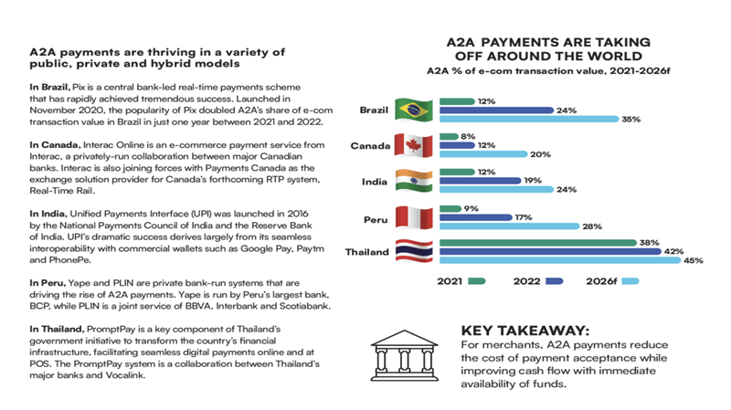

A2A payments have long been used between businesses and, more recently, in person-to-person use cases like Swish in Sweden or VIPPS in Norway. But now they are taking off as person-to-business (P2B) payments. The report anticipates significant growth in existing A2A schemes and the emergence of new schemes, as more countries recognise the benefits for merchants and consumers.

Approaches vary around the world. Peru’s Yape and PLIN A2A systems are run by private banks, while in Thailand, PromptPay is a major government initiative designed to transform the country’s financial infrastructure by offering instant payments between accounts both online and at point of sale. As the graphic below shows, systems in Brazil, Canada, and elsewhere are also set for rapid growth).

The rise of open banking in European markets like the Netherlands and the UK is adding to the growing interest in A2A payments between people and businesses. New payment types like variable recurring payments promise to take the hassle out of managing utility bills, club fees, and other regular payments.