Active equity funds gain ground on trackers in H1 2023

Update

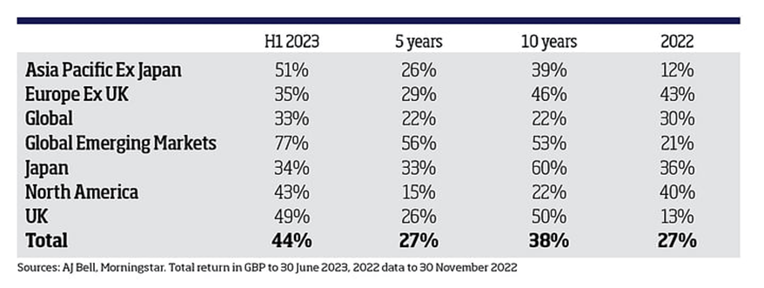

After a bleak 2022, the performance of active equity funds has seen an uptick relative to trackers in the first half of this year. AJ Bell’s Manager versus Machine report found that active equity fund managers saw a substantial improvement in performance in the first six months of 2023, with 44% outperforming a passive alternative, up from 27% in 2022.

However, tracker funds are overwhelmingly winning the active versus passive battle over the long-term. The report found that only 38% of active managers have beaten a passive comparator in the last 10 years. The popular global sector continues to disappoint, with only a third of global active funds managing to beat a passive competitor in the first half of 2023. Over a 10-year period, just 22% of active funds have outperformed trackers.

However, AJ Bell head of investment analysis Laith Khalaf noted long-running market trends that ‘provide some mitigation’ for active managers, highlighting in particular the dominance of US tech stocks. ‘There is now a cluster of large technology companies who make up a larger proportion of the global stock market than entire European stock exchanges that have been around for centuries,’ he said. Both Apple and Microsoft now matter more to global stock market performance than the entire UK stock market.

The report also found a marked improvement in the performance of UK equity funds relative to passives. Almost half of UK equity funds beat the passive machines in the first half of the year, considerably higher than the 13% who outperformed in 2022.

Percentage of active funds outperforming a passive alternative