Are you ready for the Investment Firms Prudential Regime (IFPR)? – Part One

The Investment Firms Prudential Regime (IFPR) introduced a single prudential regime for all MiFID investment firms regulated by the FCA. IFPR established a risk-based approach that focuses on capturing any risks arising from the firm’s activities that could pose threats to its clients and the markets in which it operates. The regime represents a major change for these firms and the FCA considered it critical that firms adequately prepare for the regime, which came into force on 1 January 2022.

The MiFID firm types BIPRU, IFPRU, and exempt CAD, have ceased to exist and all MiFID firms are categorised as either SNI (small and non-interconnected) firms or non-SNI, depending on the regulatory activities they carry out and the financial thresholds they meet.

Categorisation of firms

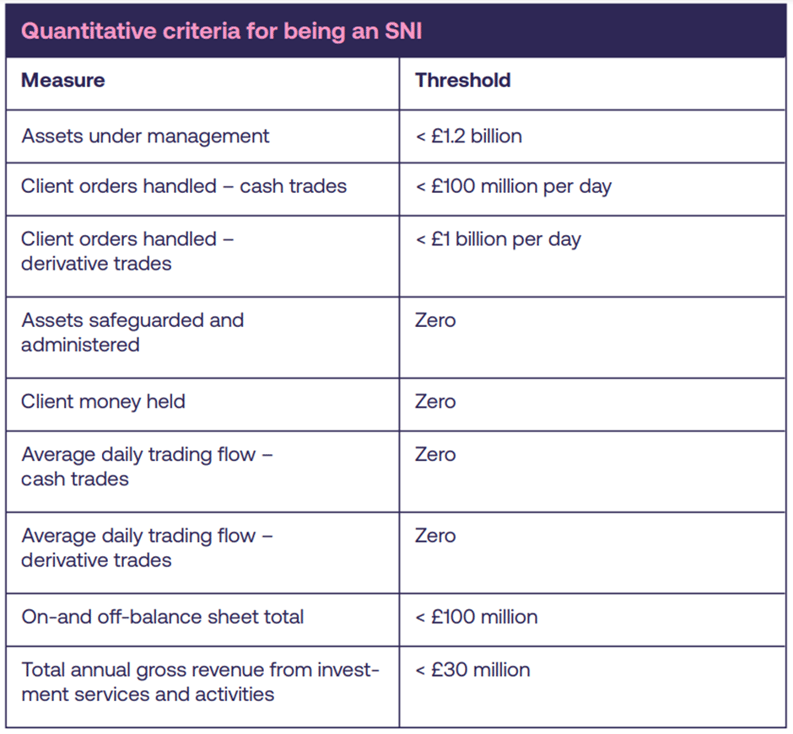

There is a series of permission-based and quantitative thresholds for firms to determine whether they are a SNI or non-SNI firm. Firms with permission to deal on own account or underwriting and/or placing on a firm commitment basis cannot be an SNI.

The quantitative thresholds are below:

These thresholds, except the on-and o -balance sheet total, only relate to the MiFID activities undertaken by the firm. A firm may manage assets without undertaking portfolio management or ongoing investment advice under MiFID or hold client money or client assets in relation to non-MiFID activities. These should be excluded from the threshold measurement.

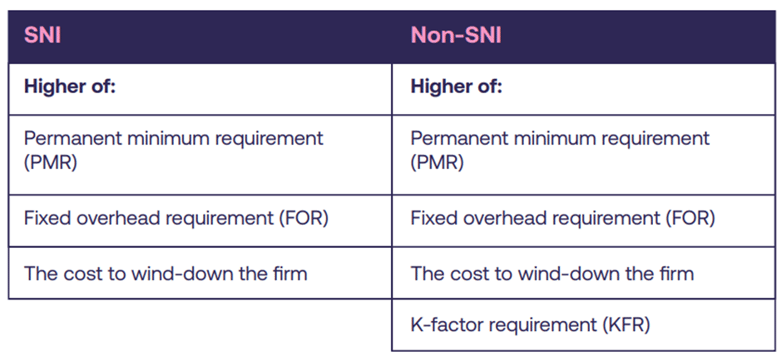

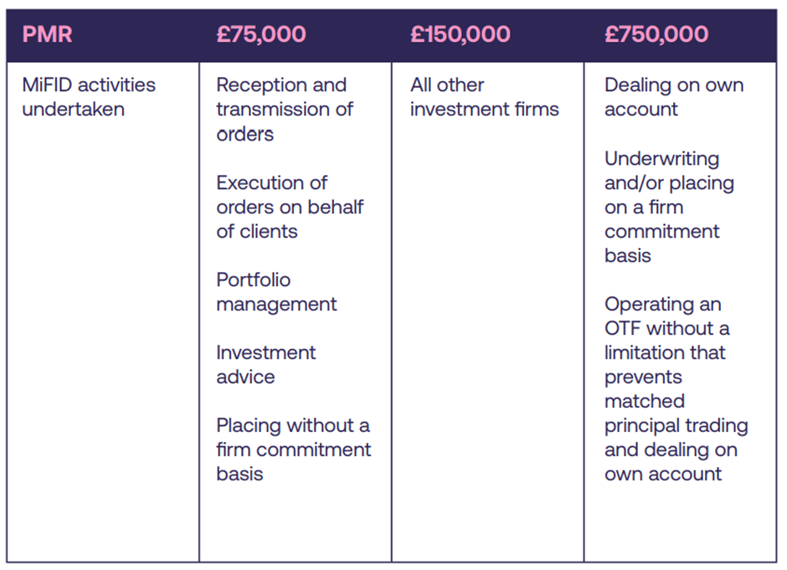

Own funds requirement

PMR is the minimum capital requirement applicable to each firm based on

its permission profile.

K-factors explained

K-AUM

Is the K-factor requirement for the amount of own funds investment firms are required to hold against risks associated with managing assets for clients. It covers both assets managed on a discretionary portfolio management basis and assets under an ongoing non-discretionary advisory arrangement.

K-ASA

Is the K-factor own funds requirement assigned against the risk of harm associated with the safeguarding and administering of a client’s financial instruments.

K-CMH

Is the K-factor own funds requirement for the amount of client money an investment firm may hold.

K-COH

Is the K-factor own funds requirement designed to cover potential risks from both the execution of orders in the name of the client and the reception and transmission of client orders.

K-NPR

This is a direct application to investment firms of the standardised market risk provisions of the CRR, together with the revised approaches to market risk introduced by the CRR 2 in the future once these become applicable to credit institutions for binding own funds requirement purposes.

K-CMG

Only applies to investment firms that deal on own account and is an alternative to K-NPR to provide for market risk, that builds upon the systemic resilience created by EMIR and use of a clearing member.

K-TCD

Is a K-factor own funds requirement that aims to capture risks from trading counterparties failing to meet their obligations to the investment firm.

K-CON

Is a further own funds requirement that only applies to exposures in the trading book for investment firms that deal on own account.

K-DTF

Is designed to capture operational risks related to the value of trading activity an investment firm conducts throughout each business day.

Read Part Two - Are you ready for the Investment Firms Prudential Regime (IFPR)? – here

Visit our ICARA & FCA Reporting services page for more information.

How can we help you?

Thistle Initiatives has supported firms for over 10 years as a trusted compliance and regulatory advisor. In addition to assisting you as and when our team of specialists can serve as your right hand in a meeting and complying with regulations. We understand the importance of staying up-to-date and compliant and are dedicated to providing the guidance and support needed to do so.

We’ve already supported hundreds of to understand, and navigate implement the Investment Firms Prudential Regime (IFPR). Since the regime came into force in January 2022, we have been assisting firms with their ICARAs, which all MiFID investment firms are required to establish.

Thistle Initiatives can:

• Provide your firm with an ICARA template,

• Assist you in preparing your firm’s ICARA,

• Provide template policies, such as a Risk Management policy and Remuneration policy,

• Calculate your firms K-Factors

We continue to assist those firms with work still to do – or who simply want to verify they’ve got it right. Get in touch with us by calling 0207 436 0630 or sending an email to info@thistleinitiatives.co.uk.