Financial promotions quarterly data 2022

What has happened?

When it issued its Q3 2022 financial promotions quarterly data in November 2022, the FCA disclosed that it had intervened with firms to amend or withdraw 4,151 financial promotions between July and September, the highest number since it started publishing the data.

What are the key points in the data?

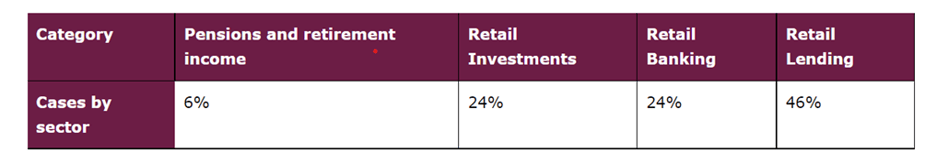

Retail lending (with 46%), investments, and banking are the sectors with the highest rate of amendments to or withdrawal of promotions and they amount to 95% of the FCA's interventions with authorised firms. A detailed split between the sectors is shown below.

On the lending side, the FCA’s intervention resulted in 66 Buy Now Pay Later promotions from one firm across various social media platforms being amended or withdrawn since they did not give fair or prominent risk warnings and were misleading about fees. The FCA wrote to the firm requesting that it address the concerns. The firm then amended or withdrew promotions across multiple media channels to provide more balance to its promotions; this ensured consumers were aware that these promotions related to a credit agreement and that they should carefully consider their circumstances before using this type of credit.

Although the FCA does not yet regulate BNPL it had warned BNPL firms about misleading promotions earlier this year.

The FCA identified a debt advice firm that was breaching the financial promotions rules across multiple platforms, including the firm’s website, social media, and Google ads promotions. The firm used the phrase ‘no credit check’ and stated that an application would not affect a consumer’s credit score. Whilst the firm does not conduct an assessment itself, consumers could be misled into believing that no credit checks would be performed.

The debt advice firm also had misleading claims regarding the immediacy of funds and omitted the credit broker statement, representative example, and representative APR.

Given that the firm’s breaches were across many platforms and in view of the potential vulnerability of consumers searching for a credit check-free loan, the FCA imposed a voluntary requirement (VREQ) that the firm amends or withdraw all financial promotions that fail to comply with the relevant handbook rules. This resulted in 28 promotions being amended.

How can we help you?

If you’d like to know more about how we can help you with your financial promotions (including social media) arrangements, or any other regulatory compliance issues, our expert team is here to help.

Contact us today on 0207 436 0630 or email info@thistleinitiatives.co.uk.