Is your cryptoasset business now prepared for regulation?

The FCA is now the anti-money laundering and counter-terrorist financing supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (the MLRs).

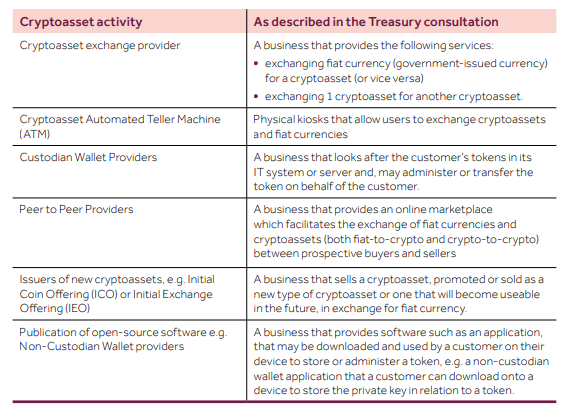

Any UK business conducting specific cryptoasset activities falls within scope of the regulations and will need to comply with their requirements. Cryptoasset businesses carrying on any of the activities listed below have needed to comply with the MLRs since 10 January 2020.

What do the regulations require?

Amongst other things, they require cryptoasset businesses as defined above to:

-

- Identify and assess the risks of money laundering and terrorist financing which their business is subject to

- Have policies, systems and controls to mitigate the risk of the business being used for the purposes of money laundering or terrorist financing

- Where appropriate to the size and nature of the business, appoint an individual who is a member of the board or senior management to be responsible for compliance with the MLRs

- Undertake customer due diligence when entering into a business relationship or occasional transactions

- Apply more intrusive due diligence, known as enhanced due diligence, when dealing with customers who may present a higher money laundering or terrorist finance risk. This includes customers who meet the definition of a politically exposed person

- Undertake ongoing monitoring of all customers to ensure that transactions are consistent with the business’s knowledge of the customer and the customer’s business and risk profile

What action must you take now?

New businesses carrying out UK-based cryptoasset activity in scope of the MLRs (including providing an ATM) must be registered with the FCA before conducting business – online registration forms are available on Connect, see here. This process can take up to three months and will require firms to provide information on, for example, their activities, the business plan, the structure of the business and its governance and systems of controls and their individuals, close links and controllers. Many individuals, including firms’ beneficial owners, directors or partners and heads of compliance and financial crime will need to pass a fit and proper test before they can be appointed, and failure to pass this will mean that the firm’s registration application will be refused. The FCA will carry out checks on all applicants seeking to pass the fit and proper test.

Existing businesses conducting cryptoasset activity before 10 January 2020 may continue their business, but they will need to ensure their compliance with the MLRs with immediate effect.

All existing businesses undertaking cryptoasset activities must be registered by January 2021. To ensure this deadline is met, these businesses must submit a completed application for registration via Connect by June 2020. A registration fee is payable both by firms already registered and by new registrants, and no application will be deemed complete by the FCA until it is paid. The fee is £2,000 for businesses with annual UK cryptoasset income up to £250,000 and £10,000 for businesses with annual UK cryptoasset income greater than £250,000.

The FCA defines income as the gross inflow from economic benefits (that is. cash, receivables and other assets) recognised in the registered UK entity’s accounts during the reporting year in relation to the provision of the cryptoasset activities specified in the MLRs.

An annual fee based on income will also be payable.

Annual fees will be calculated in a similar way to assigned periodic fees. The FCA aims to recover its ongoing regulatory costs by grouping fee-payers into a series of ‘fee-blocks’ bringing together businesses engaged in similar activities. The FCA calculates the fees for each business within a fee block based on a ‘tariff’ measure common to all fee-payers in that block. Income is the most common tariff base, as it’s normally easy to discover from company accounts, distributes cost recovery according to market share, and provides a fair and proportionate proxy for the regulatory impact risk of the various fee-payers within a block.

Existing Financial Services and Markets Act firms, e-money institutions or payment services businesses already undertaking cryptoasset activity will also be required to apply for registration.

The FCA will proactively supervise firms’ compliance with the new regulations and has stated that it will take swift action, including enforcement action, where firms fall short of the desired standards and cause risks to market integrity.

How can we help you?

In the meantime – with time potentially in very short supply – if you’d like immediate practical assistance with the process of preparing your cryptoasset firm for AML/CTF regulation, our expert team can help.

We can advise on how the new rules apply specifically to your business and exactly what you need to do to prepare. We can also take on some of the spadework for you. This can include:

-

- An AML audit of current operations

- A suite of AML compliance policies and procedures

- AML training

- Assistance with preparing your application for registration with the FCA

- Advising on business plans and on the fit and proper test for individuals

Contact us today on 0207 436 0630 or email info@thistleinitiatives.co.uk.