New Payments Architecture

What is the New Payments Architecture?

The New Payments Architecture (NPA) is intended to create a retail payment infrastructure that will keep the UK at the forefront of payments development.

What are the key points of the NPA?

The original intention for the NPA was that it would consolidate all current payment types, including Faster Payments, the Bankers’ Automated Clearing Systems (BACS), the Clearing House Automated Payments System (CHAPS), and Cheque and Credit Clearing (C&CCC), into a single, central, modern ISO 20022-compliant architecture.

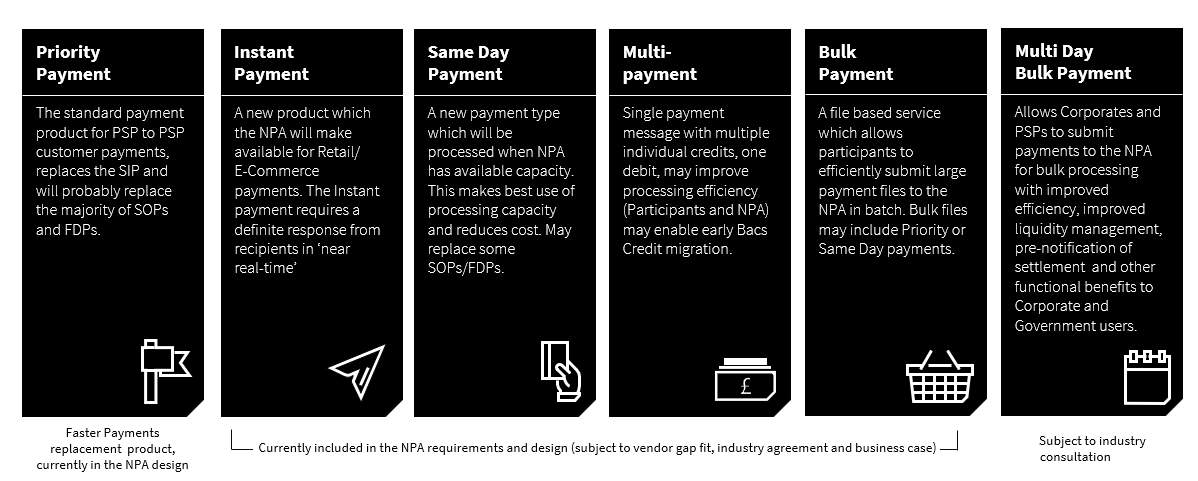

Following a regulatory review in 2021, the scope of the NPA was narrowed to focus on the replacement of the Faster Payments interbank payments system, with the option, subject to regulatory agreement, to also include BACS at a later stage. The aims of the modernisation of Faster Payments are to simplify the scheme, to provide access for new participants such as challenger banks, fintechs, and regtechs, to accelerate innovation, to increase competition, and to deliver a range of new payment services at lower costs (see the graphic below).

The benefits expected to flow from this modernisation include security (giving users and businesses the opportunity to choose among all payment types while ensuring protection has been identified as a key benefit by the Payments Systems Regulator), adding value (modernisation will also enable the development of new digital overlay services (also known as value-added services) connected to a single payments infrastructure, instead of having multiple connectors and different integrations), data enrichment. (richer data sets will allow more information to be included with the payments message to support and enrich downstream payment processes, such as reconciliations, and agility (the NPA brings new technology that enhances innovation and is more scalable and flexible).

In February 2022, UK Faster Payments participants had to submit documentation to Pay.UK (the recognised operator and standards body for the UK’s retail interbank payment systems) to demonstrate their level of preparedness for the NPA, including how they will comply with the NPA, a milestone plan and an impact assessment including the required system changes. In April 2023, the NPA certification testing window will open for all interested financial institutions, and around mid-2024 the NPA scheme is scheduled to go live.

Participants are expected to start testing the new infrastructure from Q2 2023, meaning that 2022 is a critical year for planning how to implement the NPA.

How can we help you?

If you’d like to know more about how we can help you with your payment arrangements, regulatory permissions, or any other regulatory technology services, our specialist team is here to help.

Contact us today on 0207 436 0630 – or email info@thistleinitiatives.co.uk.