Nine out of ten investment trusts end H1 on discount

Update

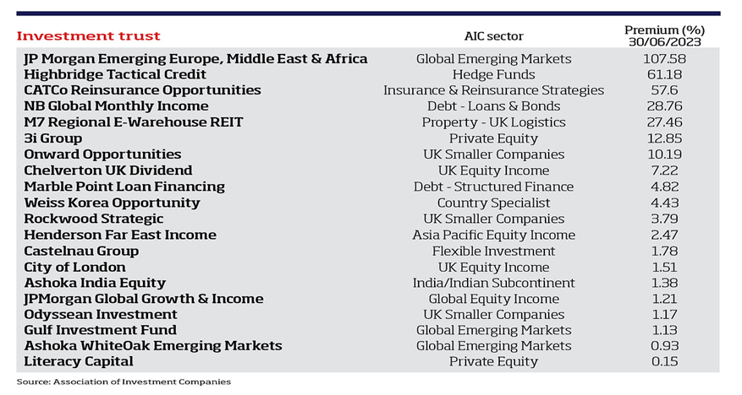

Investment Week has found that just 20 out of 231 investment trusts (around 8.7% of trusts) ended H1 on a premium, as the war in Ukraine, high inflation, and rising interest rates continued to take their toll.

Data from the Association of Investment Companies (AIC) showed that 211 trusts across the equities, alternatives, and flexible universes ended the first half of the year on a discount. As a result, the already small number of trusts trading on a premium dwindled even further, down 43% from the 35 that opened the year with no discount.

Investment trusts on a premium at the end of H1 2023

AIC head of intermediary communications Nick Britton told Investment Week that investment trust discounts had been widening since Russia’s invasion of Ukraine in 2022, but that persistently high inflation and interest rates have pushed them even further.

‘They are now at historically wide levels,’ Britton said, ‘comparable to those we saw briefly during Covid or, for a more extended period, during the Global Financial Crisis. He added that income-and-growth-focused mandates, in particular, had taken a hit from a tighter monetary policy environment.

‘Investment companies focused on income-producing alternatives, such as property and infrastructure,’ Britton said, ‘have been repriced by the market in response to higher risk-free yields from government bonds.’