The FCA has issued Consultation Paper CP 21/36 on its proposed Consumer Duty

What has happened?

In December 2021, the FCA issued its Consultation Paper CP 21/36 on the proposed Consumer Duty, which is intended to ensure a higher and more consistent standard of consumer protection for users of financial services and help to stop harm before it happens.

The FCA expects to publish the policy statement summarising responses and to make any new rules by 31 July 2022. However, it considers at this stage that firms should have until 30 April 2023 to fully implement the Consumer Duty, which implies that a transitional arrangement may be applied. Please continue reading for a comprehensive FCA compliance support update on the latest developments including any potential SM&CR implications.

What do you need to do?

Key issues on the Consumer Duty

The FCA states in the CP that;

The Consumer Duty will bring about a fairer, more consumer focused, and level playing field, building on our previous interventions in markets and recognising the changing environment for consumers, by:

- explicitly setting a higher standard of care across all retail markets, informed by our work on behavioural biases and vulnerability,

- extending rules focused on product governance and fair value, which already exist in certain sectors, across all sectors,

- focusing on matters of market practice (e.g. sludge practices1) that interfere in consumer decision making and, by doing so, cause harm,

- ensuring firms consider the needs of their customers – including those with characteristics of vulnerability – and how they behave, at every stage of the product or service lifecycle, and

- requiring all firms to focus on good customer outcomes and whether those outcomes are met

1 that is, barriers to the customer journey which can add friction and, in some cases, may lead customers to make decisions that are not in their best interest.

Implications for firms

There is a wide range of implications for firms, including the following;

• The Consumer Duty sets a higher standard of care and expectation beyond the FCA’s current set of Principles and rules. It is not a ‘duty of care’.

• The Consumer Duty relates to regulated activities (and to unregulated activities that are ancillary to regulated activities) involving retail business and so will include HNW clients and prospective customers and exclude professional clients and eligible counterparties.

• It is proposed that the Consumer Duty would apply to firms (even to wholesale firms) that have a material influence over:

-

- the design or operation of retail products or services, including their price and value,

- the distribution of retail products or services,

- preparing and approving communications that are to be issued to retail clients, or

- direct contact with retail clients on behalf of another firm, such as firms involved in debt collection or mortgage administration

- It is proposed to exclude from the scope of the Consumer Duty activities that involve the issuance of non-complex financial instruments and non-retail financial instruments.

- Authorised firms approving financial promotions on behalf of unauthorised third parties would be subject to Consumer Duty.

- Only firms conducting regulated activities in the UK would be subject to Consumer Duty. The FCA is proposing to require UK distributors of non-UK products and services to take all reasonable steps to comply with the products and services outcome.

- The Consumer Duty, when implemented, would not apply retrospectively to past business. It would, however, apply, on a forward-looking basis, to existing products or services which are either still being sold to customers, or to closed products or services that are not being sold or renewed.

- There would be three elements to the Consumer Duty;

-

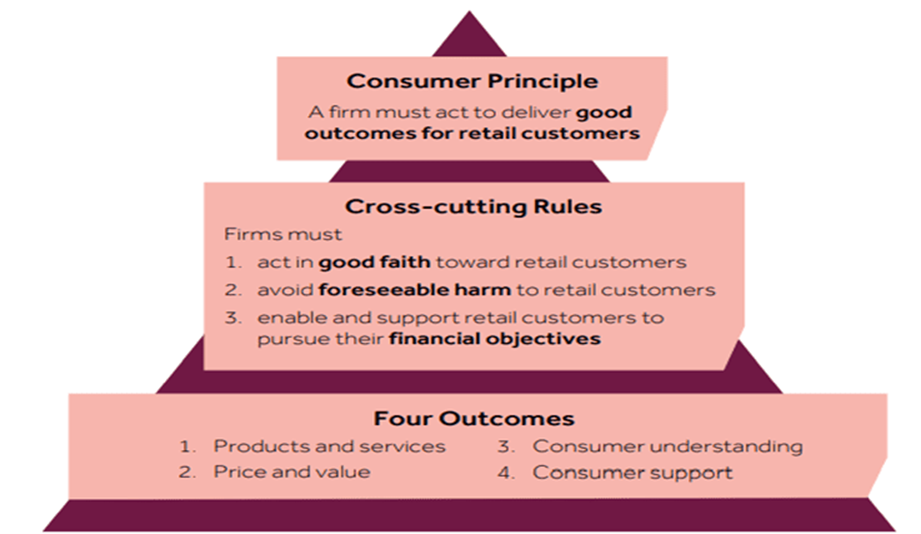

- A Consumer Principle (expected to be phrased as ‘A firm must act to deliver good outcomes for retail clients’) reflects the overall standards of behaviour expected from firms and is developed by the other two elements of the Consumer Duty,

- Three cross-cutting rules which develop the FCA’s overarching expectations that apply across all areas of firm conduct, and

- Four outcomes give more detailed expectations for the key elements of the firm-consumer relationship.

- The three elements are described graphically by the FCA as;

- The previously proposed Private Right of Action (PROA) for consumers will not be implemented at this stage and will be kept under review,

- The FCA expects firms to use the implementation period fully and to be able to demonstrate their progress when asked. It expects to carry out work during the implementation period to monitor firms and assist them. This engagement is likely to include:

- supervisory work to understand firms’ implementation plans and progress,

- reviewing implementation plans and proposed change programmes,

- engaging with firms and trade bodies to answer questions and discuss issues they raise, and

- publishing regular updates on its work with firms and further guidance and case studies

- Under the Consumer Duty, the FCA would expect firms to monitor and regularly review the outcomes that their customers are experiencing, ensure that the products and services they provide are delivering the outcomes that they expect in line with the Consumer Duty and identify where they are leading to poor outcomes or harm to consumers.

- The FCA would expect a firm’s board, or equivalent management body, to consider a report from the firm assessing whether it is acting to deliver good outcomes for its customers which are consistent with the Consumer Duty, at least annually.

- The FCA would expect firms to produce and regularly review management information on consumer outcomes. This MI should be appropriate to the nature, scale, and complexity of their business, considering the size of the firm, the products or services it offers, and the consumer base it serves.

- The Consumer Duty would be an integral part of the FCA’s regulatory toolkit and the FCA would identify and focus on practices that adversely affect consumer outcomes at an earlier stage before harm becomes widespread. Its Authorisation, Supervision, and Enforcement divisions would work to identify areas where firms’ implementation of the Consumer Duty requires interventions.

- The FCA proposes to amend the SM&CR individual conduct rules in the Code of Conduct sourcebook (COCON) to reflect the higher standard of the Consumer Duty by adding a new rule requiring all conduct rules staff within firms to ‘act to deliver good outcomes for retail customers’ where their firms’ activities fall within the scope of the Consumer Duty. Where this new rule applies, the existing individual conduct Rule 4, which requires conduct rules staff to ‘pay due regard to the interests of customers and treat them fairly’, would not apply. in effect, the proposed new rule would apply to conduct to the extent that it relates to retail activity and Rule 4 would be limited in application to conduct related to the non-retail activity. The FCA is also proposing to include obligations as part of this new individual conduct rule that reflect the Consumer Duty’s cross-cutting rules. This means that, where the new rule applies, conduct rules staff will be required to act in good faith towards retail customers, avoid foreseeable harm to retail customers, and enable and support retail customers to pursue their financial objectives.

Update

The Schroders UK Financial Adviser Pulse Survey, released on 21 June 2022, found that 53% of advisers polled are worried about the new rules while 30% say it will have no impact on their business. However, 17% of advisers believe the Consumer Duty will have an effect on their firms.

The final details of the regulation are still to emerge but many industry experts say firms are not ready. They say legacy providers in particular will find it a challenge on pricing and service.

How can we help you?

If you’d like to know more about how we can help you with your planning for the implementation of the Consumer Duty, including its SM&CR implications, or with any other FCA compliance support, our expert team is here to help.

Contact us today on 0207 436 0630 – or email info@thistleinitiatives.co.uk.