The future of UK consumer payments

Summary

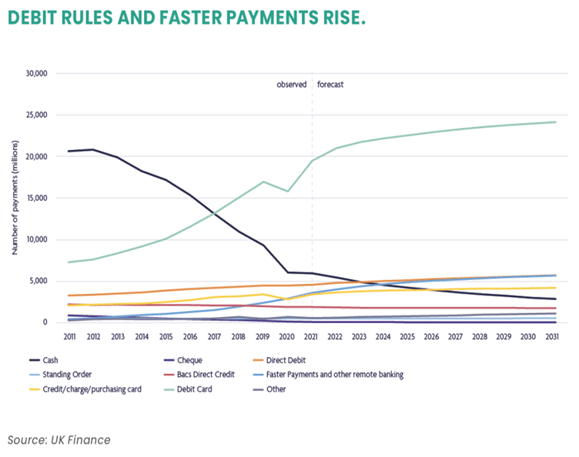

A new forecast from UK Finance predicts that debit cards will be the preferred means of payment for UK consumers ten years from now. It also forecasts a slowing rate of decline for cash payments, anticipating a continuing role for cash well into the 2030s. It foresees there being no role, however, for Central Bank Digital Currencies, despite all the hype from analysts and governments around the world.

UK Payments Market Summary 2022 notes that transaction numbers have recovered to pre-pandemic levels this year, and predicts significant growth ahead for debit card payments.

These are expected to exceed 24 billion transactions (around 60% of all payments) in 2031.

Despite widespread anticipation of the death of cash, UK Finance believes the long-term decline in cash use will slow, and that around 6% of payments will still be made in cash in 2031. Faster Payments and mobile payments are expected to account for around one in seven transactions, up from less than 1% today.

Research across all European markets suggests that eight in ten transactions at point of sale are now contactless. After coming from nowhere, contactless is expected to account for a third of UK transactions this year. By 2031, however, the report suggests, it will still only account for around half of UK credit card transactions and two-thirds of debit transactions.

Links: https://www.paymentscardsandmobile.com/the-future-of-uk-consumer-payments-no-cbdc/