UK consumers embrace alternative payment methods

Summary

The Global Payments Report 2023 shows UK consumers embracing alternative payment offerings like digital wallets as they look to manage their finances better through the cost of living crisis. The report suggests global consumers are switching to alternative payment methods (APMs) as they seek greater choice, convenience, and control at the checkout.

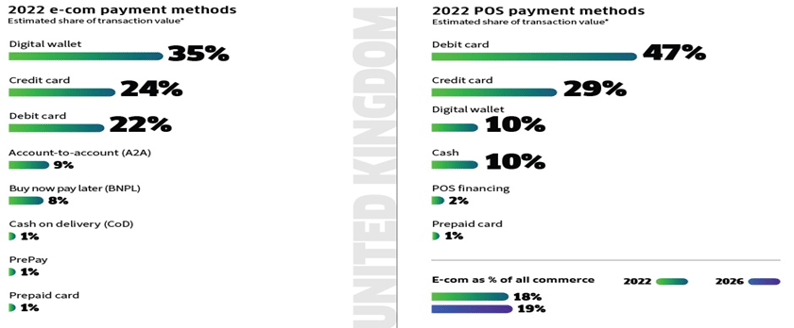

Digital wallets were the leading payment method for UK consumers shopping online in 2022, accounting for 35% of e-commerce transaction value, and increasing their share of POS transaction value to 10%.

With consumers looking to manage their finances better as costs bite, buy-now-pay-later (BNPL) increased its share of e-commerce transaction value to 8% of e-commerce spend in 2022, up 33% year on year from 2021.

Account-to-account (A2A) payments are also on the rise, accounting for 9% of UK e-commerce transaction value in 2022, up from 8% in 2021.

Alternative payment methods are also gaining e-commerce share across Europe, but European consumers’ payment preferences (see below right) differ significantly from those in the UK (left).

While the UK leads the region in digital wallet share, it lags in A2A adoption. A2A payments in both Poland (where they account for 67% e-commerce transaction value) and the Netherlands (62% of e-commerce transaction value) have a much larger market share.

In Sweden, BNPL is now the leading payment method, with 24% of e-commerce transaction value. In Turkey, credit cards account for 53% e-commerce transaction value.

Links: https://www.paymentscardsandmobile.com/uk-consumers-embrace-alternative-payment-methods/