UK signs Berne Agreement with Switzerland

What has happened?

In December 2023, the UK signed the Berne Agreement with Switzerland. The agreement uses outcomes-based mutual recognition of domestic laws and regulations to enable cross-border trade in financial services for wholesale and sophisticated clients.

HM Government will seek to implement and ratify the agreement in due course, in line with UK domestic parliamentary processes. The agreement has to be approved by the parliaments of both countries before it can come into force and the likely date for this to happen is not yet known.

What are the key points of the agreement?

At the heart of the agreement is a new and innovative model of mutual regulatory recognition. This is intended to provide stability for UK businesses supplying financial services to clients in Switzerland and it supports new market access secured through the agreement. It will also reduce regulatory barriers for the sectors it covers, making doing business with Switzerland easier than before.

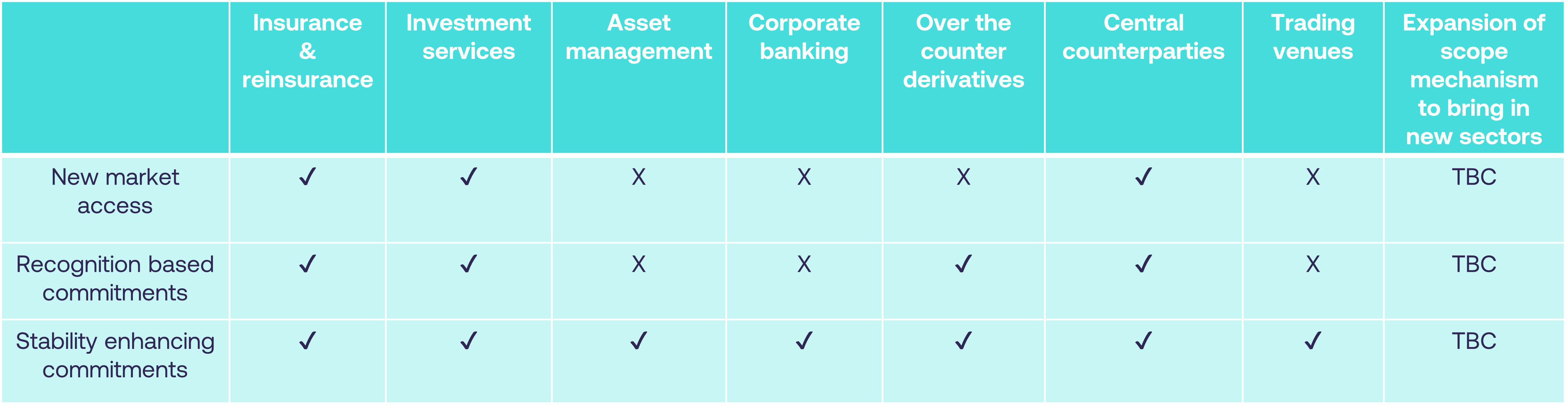

The Agreement draws in the vast majority of wholesale financial services sectors (see the explanatory table below), setting an unprecedented breadth for a financial services agreement of this kind. This broad scope is designed to foster a more integrated and efficient financial services landscape between the UK and Switzerland, allowing firms to operate more seamlessly across borders and promoting healthy competition across industries. For some sectors, the agreement unlocks new market access and establishes deference commitments1 and in others, where the UK or Swiss regimes already permit liberal cross-border access, it introduces stabilising provisions to help maintain the status quo.

1 Under the agreement, one country defers to the relevant standards in the other country where the first country decides that regulated and supervised financial services suppliers from the other can provide services on a cross-border basis into the first country without needing to comply with the regulatory and supervisory rules that apply to other financial services suppliers.

High-level details in certain of the areas identified are explained in HM Government’s “Benefits for the UK” document, as follows.

Insurance

The agreement provides access for UK insurers and intermediaries providing wholesale services into the Swiss domestic insurance market, going beyond what Switzerland has offered to any other trading partner to date. When implemented, it will secure immediate access for many wholesale lines of non-life business which are of value when dealing with large corporate clients. This includes, but is not limited to, the provision of policies in the areas of renewable energy, directors’ & officers’ liability, sellers’ and buyers’ warranty, indemnity, and cyber insurance. The commitments from Switzerland are based on deference, which means that UK insurers will be able to provide a wide range of wholesale services into the Swiss market with significantly reduced Swiss regulatory requirements, relying largely on familiar UK regulation.

The agreement introduces a flexible and transparent mechanism that will allow the UK and Swiss authorities to expand on the agreement’s initial sectoral coverage, including adding new financial services sectors into its scope. This is not required to take place during the agreement’s formal review points and it can, with the agreement of both nations, be done at any time. The agreement already marks sustainable finance as one of the first areas that HM Government aims to bring within its scope.

Investment Services

The agreement builds on the liberalised access UK firms have into the Swiss investment services market by introducing commitments designed to stabilise the access routes currently available to service institutional and professional clients, including high net worth individuals. This deal ensures that it will be easier than before for client advisers acting on behalf of UK firms to provide services directly to their clients whilst in the territory of Switzerland. Client advisers will no longer need to be registered by Swiss registration bodies, nor will they have to prove to these bodies that they meet the requirements necessary to provide their services to private clients in Switzerland. This will do away with the need to sit examinations and provide documentation relevant to the registration process.

HM Government has also built on the UK’s cross-border investment services regime under the Markets in Financial Instruments Regulation (MiFIR) to provide Swiss investment services firms with a new access offer to the UK market. Whilst the access granted is similar to Article 47 of UK MiFIR, HMG has made two major improvements to the framework within the offer. It has granted Switzerland access in a way that allows for other forms of access to the UK’s domestic market to remain open; this means that Swiss firms will have the choice of continuing to rely on the overseas persons exclusion or using this agreement to service clients in the UK. It has also created a new and bespoke mechanism for Swiss firms to do business with sophisticated high-net-worth investors. This has been designed to ensure access to these clients by Swiss firms will come with appropriate disclosures to clients, but at the same time, will broaden the choice available to sophisticated UK clients.

How can we help you?

Thistle Initiatives has supported firms for over 10 years as a trusted compliance and regulatory advisor. In addition to assisting you as-and-when, our team of specialists can serve as your right hand in meeting and complying with FCA regulations. We understand the importance of staying up-to-date and compliant and are dedicated to providing the guidance and support needed to do so.

Are you looking for help with planning your arrangements for doing business in Switzerland, or more general regulatory questions? Contact our specialist lending team now to schedule a free consultation. Get in touch with us by calling 020 7436 0630 or sending an email to info@thistleinitiatives.co.uk.